Podcast

The Jump Off Point Podcast Pilot Episode with Bill Harris

2/25/2021

Over the last few years, the crypto credit market has grown exponentially, with BlockFi reaching over $15 billion of assets on their platform, Genesis originating $7.6 billion in loans in Q4 of 2020 alone, and Compound reaching over $5 billion in outstanding debt. At Jump Capital, we believe the crypto credit market will continue to rapidly expand and enable the next generation of iconic global financial institutions to be built on crypto rails. We are proud to be investors in several innovators in this space including BlockFi, Voyager, BitGo, Zipmex, and CoinDCX. In this 3-part post, we describe why the crypto credit market offers high interest rates which are drawing in billions of dollars of deposits, who the major players are, and how we expect the market to evolve over time.

Nearly every day, we get messages from friends asking us about the savings interest rates offered by companies such as BlockFi and Voyager. These rates, which are often over 8% on dollars (cryptodollars) and over 5% on bitcoin, seem unbelievable in a world where the average savings account yields 0.05%. That’s right, if you haven’t heard, you can earn 8%+ on dollar deposits*.

Unsurprisingly, these high yields are drawing in massive amounts of customers and assets. To understand how these yields are possible, we must understand who is willing to borrow at these rates.

If 8%+ can be earned on deposits, someone must be willing to pay at least 8% (plus some spread) to borrow that capital. Who is willing to pay these high rates? A few parties, specifically:

Traders are far and away the largest borrowers in the crypto credit market. They borrow at these elevated rates because they believe they can earn higher returns from trading activities than they pay in interest. Some of the ways traders earn these returns are from tried-and-true strategies that take advantage of market inefficiencies, and others are more speculative in nature. Traders are huge borrowers in the crypto credit market because:

Breaking this down further, there are two general strategies traders borrow to fund.

One type of trading is “arbitrage” trades, which are based on inefficiencies in the market or market structure dynamics which provide the trader a positive expected return.

The three most well-known trades in this category we will refer to as "Basis Trade", “Cross-Exchange Arbitrage,” and the “Grayscale Trade”.

The Basis Trade takes advantage of the fact that bitcoin (and other crypto asset) futures often trade significantly above the price of spot bitcoin (and other crypto assets respectively). For this trade, a trader buys the spot and sells the future, capturing the difference between these prices at the maturity of the future.

Cross-Exchange Arbitrage is the simple arbitrage of pricing differences across exchanges. For example, if bitcoin is trading at $50,000 on Coinbase and $50,005 on Bitstamp, a trader will buy on Coinbase, simultaneously sell on Bitstamp, and net a risk-free $5 (minus trading fees). Years ago, wide price disparities between exchanges were common. Today, cross-exchange price disparities rarely exceed trading fees, diminishing opportunities from this type of trade.

The Grayscale Trade takes advantage of the premium over their Net Asset Value (“NAV”) that trust products such as the Grayscale Bitcoin Trust (“GBTC”) often trade at (or at least that they used to). The dynamics of this trade apply not only to GBTC, but also to Grayscale trust products for Ethereum, Litecoin, and their large cap index, as well as trust products created by Bitwise and other companies. In this trade (using GBTC as the example), a trader borrows bitcoin, uses that bitcoin to create in-kind units of GBTC at the NAV, waits 6 months until the GBTC can be sold in the open market, and sells the GBTC to capture the premium. Recently, GBTC has traded below its NAV, which has diminished the opportunities for this trade from that specific product but has opened new opportunities for traders who believe GBTC will eventually convert to an ETF and trade at NAV (which we do). The premium to NAV has also persisted for more complex products such as the Bitwise 10 Index Fund.

The reason that these arbitrage trades have existed is largely due to investment access issues. Many investors want access to crypto assets but are unable or unwilling to directly hold the assets. For example, many retail investors want to invest in crypto out of their traditional brokerage accounts or IRAs, and many institutional investors are limited by their investment mandate to products that trade on traditional established exchanges and have a CUSIP. These groups of investors are limited to products such as CME bitcoin futures and GBTC. Due to the excess demand for these products, they will often trade above the prices of the underlying assets. This creates opportunities for traders to arb this spread – and this arb trade creates a capital need – so traders are willing to pay high interest rates to fund these trades.

The other type of trading is speculative trades, which are based on traders taking a leveraged long or short position in the market.

For investors that want to magnify their gains (and losses), using leverage is one way to do this. Leverage could come from borrowing from a third-party lender or borrowing on an exchange platform using margin. Currently, a very large amount of the crypto credit market ends up fueling leveraged trading, including most of the lending on decentralized lending protocols such as Compound and Aave. As they say, “Leverage is a hell of a drug” – and at times the crypto market goes full Scarface on this use case. We expect the crypto market to continue to go through waves of increasing leverage, which will lead to some spectacular price run-ups, and even more spectacular sell-offs when cascading liquidations inevitably hit these over-levered markets.

The other speculative trading use case is for shorting. The classic way to short an asset is to borrow it, sell it in the market, wait for it to go down, buy it back, and repay the loan. Some traders are brave enough to take on short positions in today’s market. Good for them and bless their poor souls.

That brings us to the second reason traders are big crypto borrowers – crypto trading can be extremely capital intensive. This is because the crypto exchanges require pre-funding and there are hundreds of venues to trade across. The issue with exchanges requiring pre-funding is particuarly acute for both market makers and traders who trade across exchanges to take advantage of pricing disparities or for best execution. The need to have coins and cash on every exchange you want to trade on might seem normal to retail traders, but this is not how things work in the traditional markets. In the traditional markets, traders only need to have capital at their prime broker, who will allow them to trade across many venues with this capital.

As a very simplified example, let’s assume a trader wants to have the ability to instantly buy or sell $1mm of an asset across multiple exchanges. In the traditional markets, the trader would fund $1mm to their prime broker and have the ability to trade across many exchanges (and in reality, the PB is probably providing leverage, so the trader doesn’t even need to fund the full $1mm upfront). In contrast, in the crypto market, if a trader wants the ability to instantly buy or sell $1mm of bitcoin across 10 exchanges, they need to fund $1mm of cash and $1mm of bitcoin to each of these 10 exchanges, for an upfront funding requirement of $20mm. In this example, the crypto market is at least 20x more capital intensive than the traditional markets.

Which brings us to the last reason crypto traders are big crypto borrowers – this market is not well served by traditional financial institutions. In the example above, the issue with the crypto market is not only that exchanges require pre-funding, but also that there is no prime broker stepping in to provide the pre-funding and/or leverage for the trader. For years, banks have avoided serving crypto companies due to real and perceived regulatory concerns. This bias still exists today, with some notable exceptions such as Silvergate and Signature. Since traditional banks are not interested in lending to crypto traders (other than perhaps the largest market makers), these traders look to crypto lenders for their very significant borrowing needs.

As mentioned above, traders are not the only borrowers in the crypto market. Other borrowers include retail borrowers and crypto companies.

Retail borrowers often borrow from the crypto credit market to make purchases (in addition to borrowing for trading purposes). These are often individuals who would like to make a large purchase such as buying a house but prefer to avoid the tax consequences of realizing their gains. In this case, borrowing against their crypto holdings can be very tax advantageous when compared with selling.

The other type of borrowers are crypto companies. These can be businesses that need to borrow for capital expenditures (e.g., mining businesses) or sometimes are simply businesses borrowing to fuel growth. The crypto credit market can provide these companies with access to the funds they need.

In summary, BlockFi, Voyager, and similar companies can pay high yields on assets because there are borrowers that are willing to pay high yields. These borrowers are traders, individuals, and crypto companies, with traders being the largest segment of this market. These traders are willing to pay high rates on their borrowings because they deploy these funds into arbitrage and speculative strategies that earn high returns, the crypto market is very capital intensive, and these traders are not well served by traditional lenders.

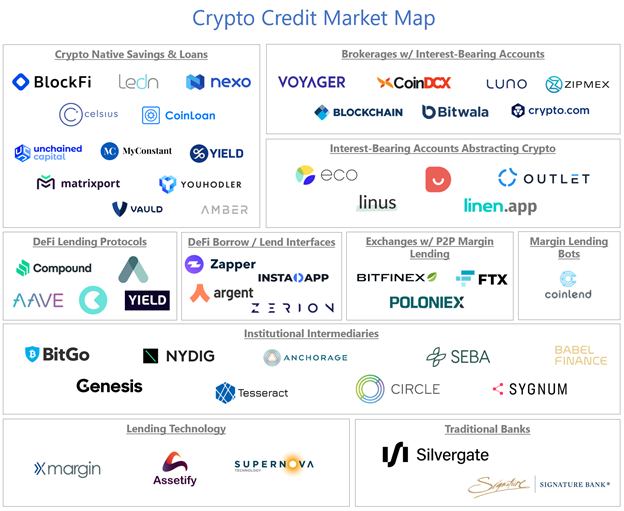

Now that we understand the dynamics driving the high rates and growth of the crypto credit market, let’s look at who the major players are. The market map below lays out the categories of companies and major players. For this, we excluded the actual lender/depositor and the end borrower to focus on the intermediaries and technology providers enabling this market.

The key players in this market include:

At Jump, we’ve been active investors in several of these categories, including Crypto Native Savings & Loans (BlockFi), Brokerages w/Interest-Bearing Accounts (Voyager, CoinDCX, Zipmex), and Insitutional Intermediaries (BitGo).

Looking forward, we continue to be interested in making additional investments in these categories, as well as investing across other segments including Interest-Bearing Accounts Abstracting Crypto, Lending Technology, and DeFi Borrow/Lend Interfaces.

We’re excited about Crypto Native Savings & Loans such as BlockFi because these companies are on the leading edge of attracting massive amounts of customers and assets with their interest-bearing accounts, and often have also developed significant lending operations with strong risk management practices. We believe that some of these companies are uniquely positioned to become the next generation of leading global financial institutions.

In the category of Brokerages w/ Interest-Bearing Accounts, we seek to invest in the best fiat/crypto on-ramps across the world. We plan to continue investing behind the best exchanges/brokerages in each major region of the world and working with these companies to add interest-bearing accounts if they do not already offer this product.

Institutional Intermediaries are attractive because we believe many providers of interest-bearing accounts will not build full lending operations to generate yields. Most will utilize intermediaries who specialize in borrowing / lending / generating yield.

Interest-Bearing Accounts Abstracting Crypto are interesting because they widen the scope of customers who can benefit from the high rates in the crypto credit market. While other crypto yield-bearing accounts primarily target customers who are comfortable with crypto, these companies target the larger market of non-crypto folks.

Lending Technology providers are compelling because right now nearly every company in the space is building their own technology for lending and interest-bearing accounts. There are significant opportunities for third-party technology providers to build best in class software to be used by the high number of companies quickly entering this space.

Finally, we’re interested in DeFi Borrow/Lend Interfaces because DeFi protocols are increasingly accessed through best-in-class interfaces which offer portfolio management, trading, lending/borrowing, earning, transfers, etc.

Overall, we think there are significant opportunities across the crypto credit ecosystem and are excited to continue investing across these categories.

As we’ve invested in the crypto credit market at Jump Capital, a key question we’ve contemplated is how this market will develop in the coming years. Specifically, we’ve questioned what will happen as the current inefficiencies in the crypto trading market correct. How and when will interest rates in the market come down, and when they do, will this market be less attractive to depositors/lenders?

Over time, we think many of the inefficiencies in the crypto trading market will correct, and rates will fall. However, we expect borrowing demand in the crypto credit market to continue to dramatically expand, and for the rates available to depositors to remain very attractive.

We are confident in the continued growth of the crypto credit market for a couple of reasons:

The first reason is straightforward – Crypto trading is still a relatively small market. It is mostly the domain of early-adopter retail traders and a few innovative trading firms. Very few institutional traders are in the market. If the market develops the way we think it will - where bitcoin is an asset in most investors’ portfolios, cryptodollars are a new global money movement rail, and DeFi offers the world a new way to access financial services - then the crypto trading market will grow exponentially in the coming years. This exponential growth will fuel borrowing needs that dwarf the decreases in borrowing from the trading market becoming more efficient.

The second reason is more important – that the crypto credit market has structural advantages over the traditional credit market. These structural advantages include:

These structural advantages have enabled BlockFi and Compound to build global multi-billion-dollar lending operations in less than five years. In the coming years, we expect these advantages to enable the crypto credit market to take significant share from the traditional lending market.

Some of this market’s expansion will come from the current use cases across crypto trading, individual crypto owners borrowing for purchases, and crypto companies borrowing to fund growth. These will not be the largest segments of growth though. The largest segments of expansion in the crypto credit market will come from non-crypto companies and individuals who have borrowing needs and may not even know that crypto is being used on the back-end to meet these needs.

In the future, many end users will be obfuscated away from the use of crypto on the back-end. Individuals will deposit their savings in interest-bearing accounts on their favorite fintech app, and companies will keep their cash in interest-bearing corporate accounts. On the back-end, these cash deposits will be converted into USDC and directly lent around the world or deployed into DeFi lending protocols, where the capital can flow to borrowers anywhere. These borrowers will be individuals who borrow from their favorite fintech app or corporations who borrow from a next-generation corporate lender who is plugged into the crypto ecosystem. Neither the lender nor borrower will necessarily think about the crypto rails that facilitated the transaction.

In many markets, speculation has paved the way for long-term technological evolutions. In the crypto credit market, the initial use case of borrowing to trade and take advantage of market inefficiencies has allowed the scaling of new financial institutions and the creation of a new global financial system. This new global financial system will reach far beyond the traders and crypto users who enabled its initial creation and growth.

*Note that these deposits are not FDIC insured, and investors should do their own research before making any investment or savings decision. In this market, working with high quality companies with sound risk management practices is very important.