Blog

Jump Capital is Growing Our Crypto Investing Team!

9/13/2021

The most comprehensive survey of the compliance vendors used by crypto exchanges, brokerages, and financial institutions.

With crypto’s rise to becoming a ~$1.5 trillion+ asset class and widespread expectations for continued exponential growth, regulators, legislators, and tax authorities around the world are increasingly focused on how crypto fits into existing compliance frameworks and crafting new crypto-specific rules. Enforcement actions have been taken towards major players such as BitMEX, Binance, and Ripple, and we believe this is just the beginning of the coming scrutiny that crypto companies will face from various authorities around the world.

In this environment, compliance is a critical, and sometime existential, issue for crypto companies, and working with the right compliance vendors is a top priority for most players in this space. As an investor in over a dozen of the leading crypto exchanges/brokerages across the world, this is a regular board discussion topic with our portfolio companies.

To help navigate the field of compliance vendors, we recently completed a survey of crypto exchanges, brokerages, and financial institutions to understand which vendors they are currently using, their satisfaction with these vendors*, and which vendors they are considering using over the next 12 months. We hope that the results of this survey will be a resource to crypto companies, regulators, and others in the industry looking to implement best-in-class compliance solutions.

*Note that vendor satisfaction ratings are not included here but are provided to all survey participants. If you are a compliance software buyer and would like the satisfaction ratings, please email [email protected] to complete the survey and receive the ratings.

We broke down this survey into the following areas:

We received responses from 27 companies, including many of the largest crypto companies in the world. Responses came from companies based in North America (59%), Europe & the Middle East (22%), Africa (7%), Asia (7%), and Latin America (4%). In the survey, we asked about the use of vendors in the areas of: Customer Onboarding (AML/KYC), Blockchain Analytics, Travel Rule, Market Surveillance, Communications Surveillance, and Tax Compliance.

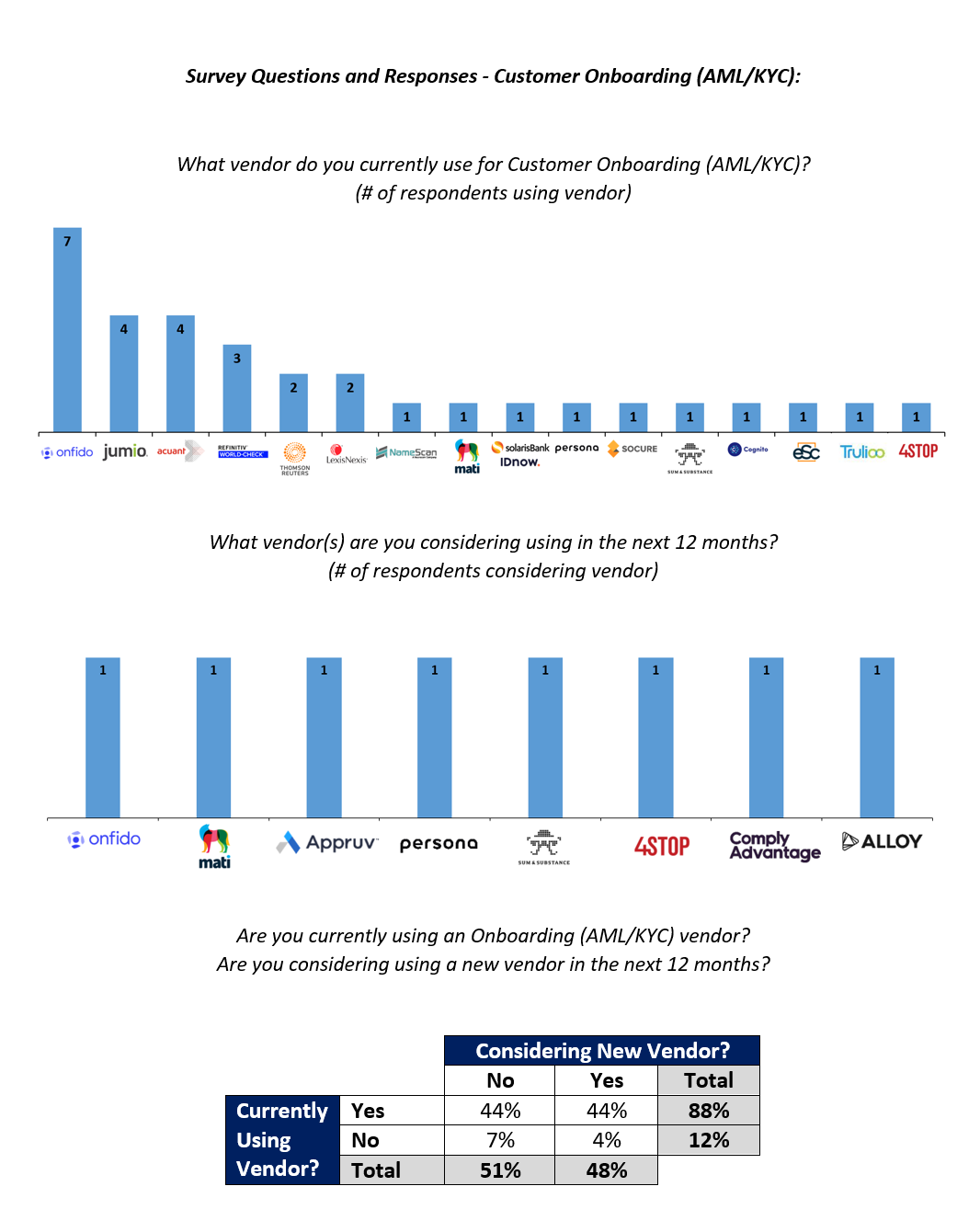

A key part of onboarding new customers is ensuring compliance with Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. Services provided by vendors in this category include acquiring data from customers and third-party databases, confirming customer identity, performing watchlist checks, and providing decisioning workflow management. At Jump Capital, we previously identified customer onboarding as an area of opportunity for new startups, and wrote about our views on the space here and here.

Use of customer onboarding vendors is rather ubiquitous, with 88% of respondents indicating that they currently use a vendor. Surprisingly, this is also an area where respondents are looking for new solutions, with 48% indicating they are considering using a new consumer onboarding vendor within the next 12 months. This included half of the respondents who are already using a vendor, indicating that crypto companies are looking for new, and better, solutions in this area. In follow-up conversations with respondents, reasons mentioned for looking for a new vendor included better coverage for regional identification documents, reducing the manual review of documents, and better customer experience / workflows.

Looking at which vendors are being used and considered, the solution landscape for these services is highly fragmented, with a total of 16 vendors being currently used by the 27 survey respondents. This is partially because many companies use multiple complementary products in this category (e.g., identify verification and sanctions screening). It also does not appear that respondents are coalescing around any emerging industry leader in this category, as when respondents were asked which vendors they are considering, 8 separate vendors were named, and each was only mentioned once.

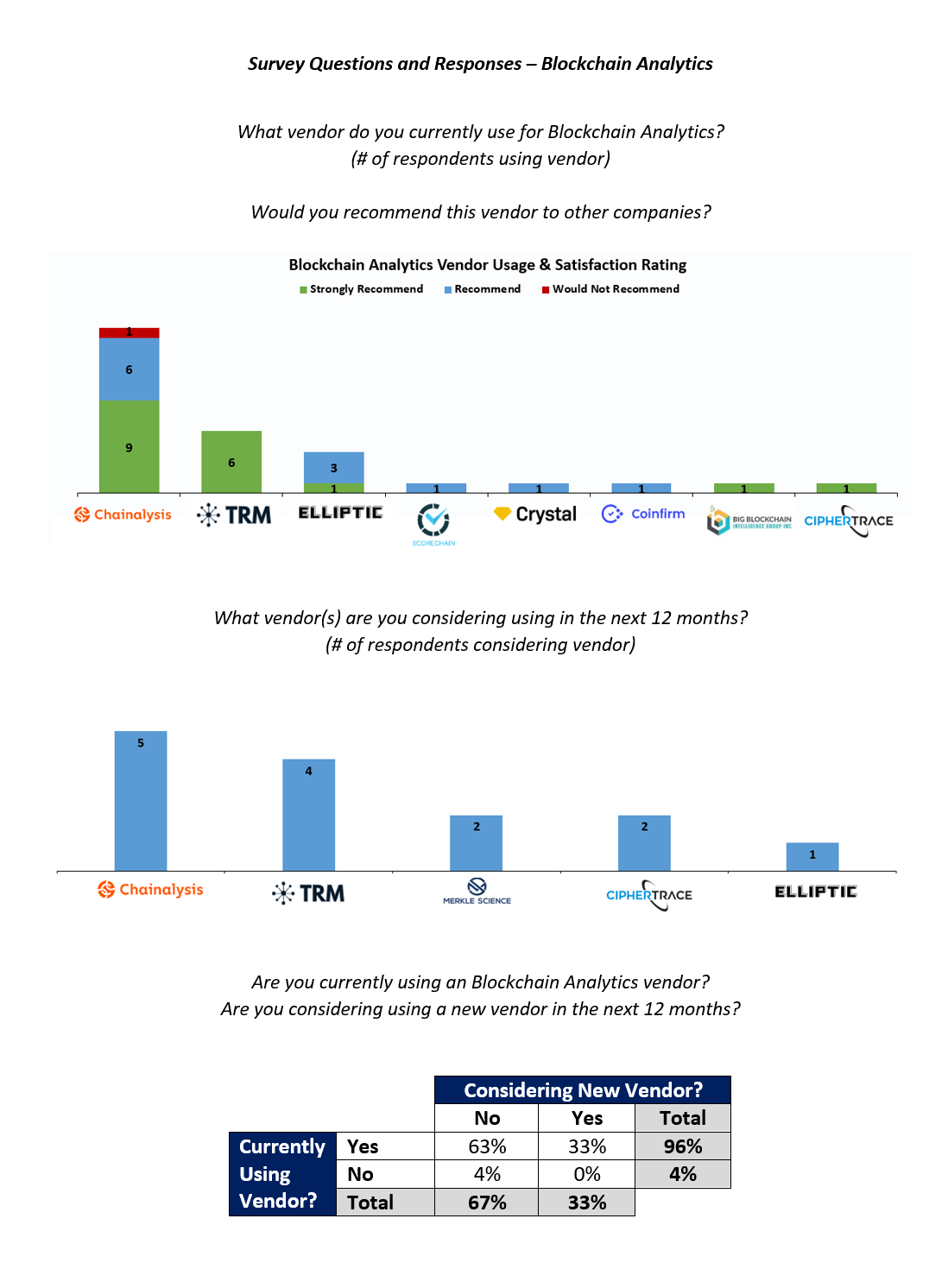

Blockchain analytics vendors provide crypto companies information on the wallet addresses coins are coming to and going from, tie those wallet addresses to real-world entities, and identify suspicious behaviors and patterns in coin movements.

Utilizing a blockchain analytics solution has become a requirement in crypto, with 96% of respondents currently using a vendor, and the remaining 4% considering using a vendor within the next year. This is an area where companies are also seeking new and better solutions, as 33% of respondents are already using a vendor but still considering using a different vendor.

As mentioned above, all satisfaction ratings will only be provided to survey respondents, but to show what these look like, we are including the satisfaction responses for this category here. Chainalysis is the market share leader, and generally has strong market share ratings, but TRM Labs had the highest satisfaction ratings – being strongly recommended by every company that uses them. Chainalysis and TRM are also the top blockchain analytics vendors that are being considered to be used over the next year and seem to be establishing themselves as the two leaders in this category.

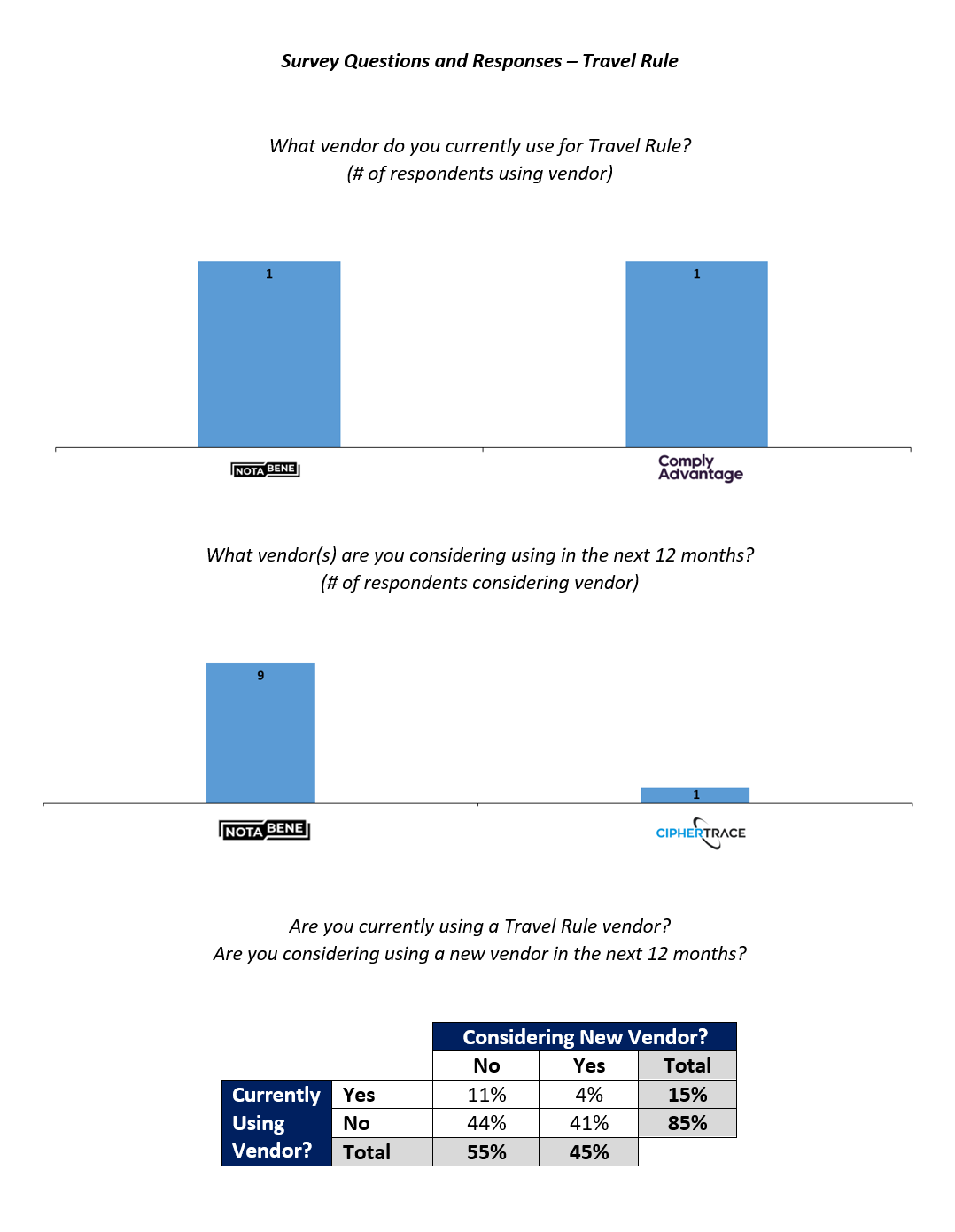

The “Travel Rule” refers to the requirement of financial institutions to collect and share sender and recipient data for financial transactions. The Financial Action Task Force (FATF) has provided guidance that crypto companies must comply with the Travel Rule, and this rule is in the process of being implemented by local authorities.

As this is a new requirement for crypto companies and many local authorities have not yet implemented the rule, only 15% of survey respondents are currently using a vendor. However, 44% of respondents are considering using a vendor within the next year.

Of the companies that are currently using a vendor, only two companies chose to disclose what vendor they are using, and the 2 vendors used are Notabene and Comply Advantage. Of these two, only Notabene is focused on the exchange of sender and recipient data, as Comply Advantage is focused on the screening of the sender/receiver after this data is exchanged. From our industry relationships, we are also aware of more than 10 companies that are signed up to use Notabene’s solution but did not complete the survey. Notabene’s strength in this category was also shown by the 9 respondents who indicated they are considering using them over the next year. Two respondents mentioned that they are part of the US Travel Rule Working Group (USTRWG), but we did not include this in our results below as this is a working group and not technically a vendor.

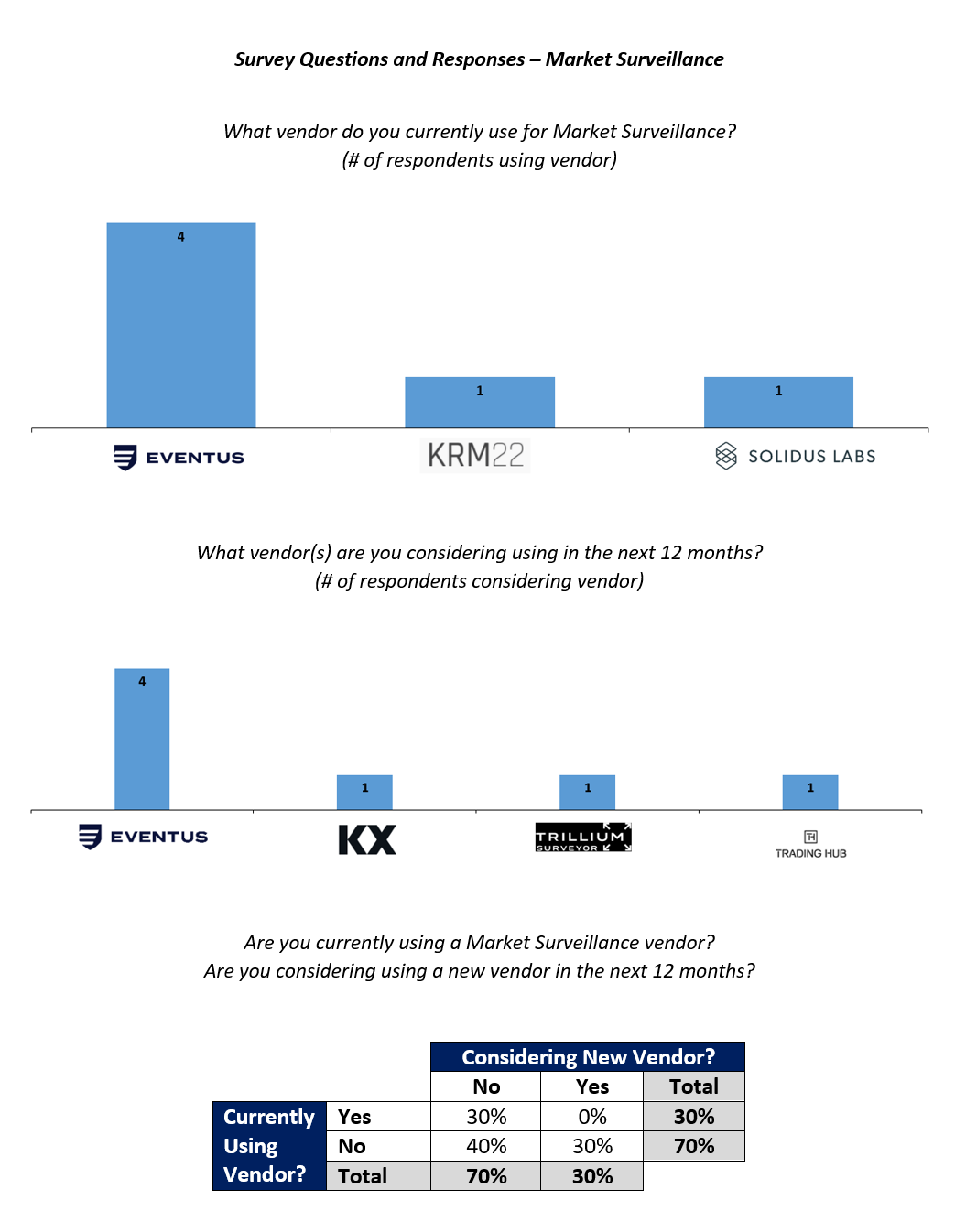

Market Surveillance is the monitoring and analytics of market data to identify market manipulation and other illegal or suspicious trading activity. The lack of comprehensive market surveillance is a hot topic in the industry, and in the U.S. has been repeatedly cited by the SEC as one of the reasons for not approving a bitcoin ETF. Use of market surveillance vendors in crypto is increasing, with 30% of respondents currently using a vendor, and another 30% considering using a vendor over the next year.

In this category, Eventus is the market leader, with 4 respondents currently using Eventus, and another 4 considering using Eventus over the next year.

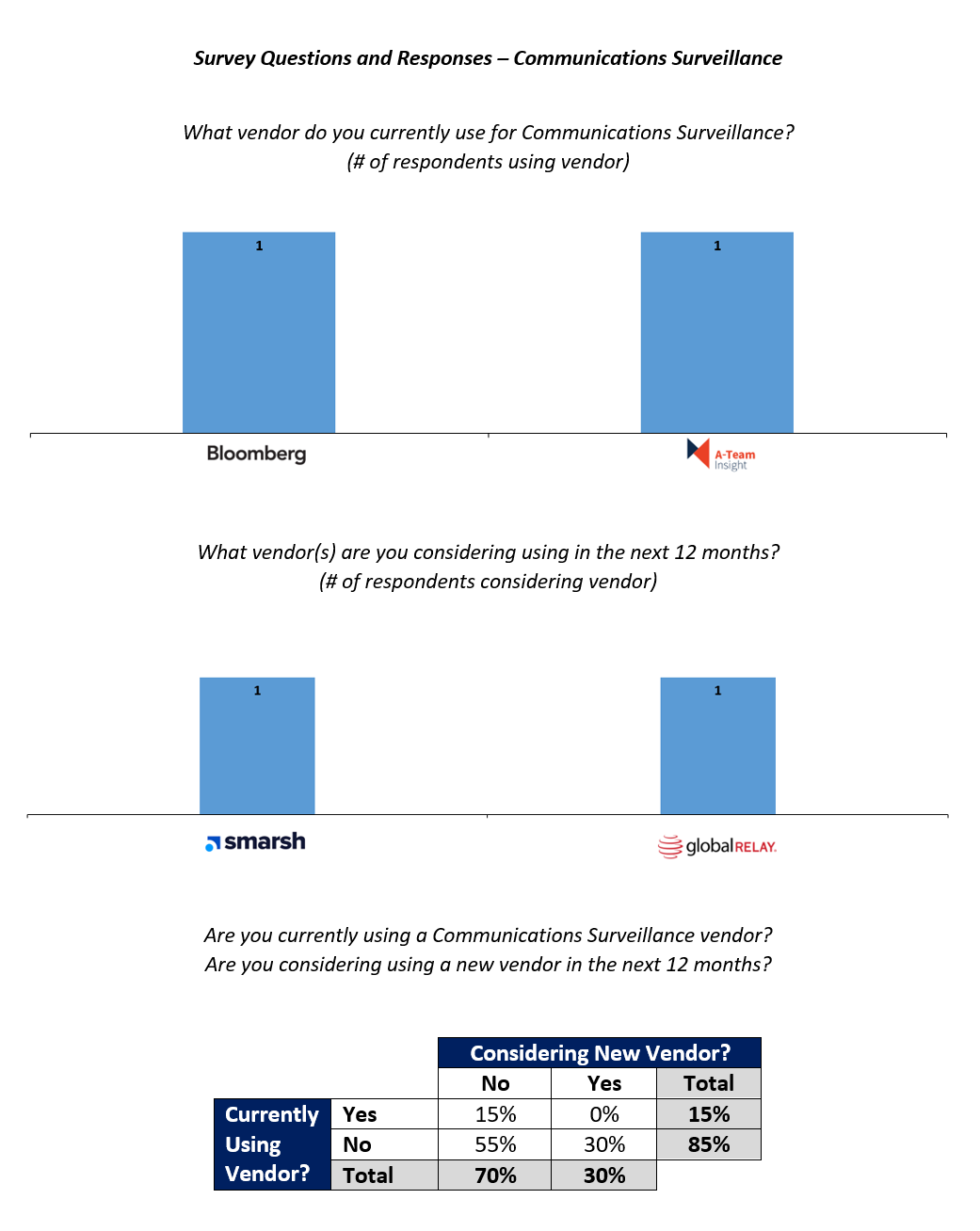

Communications Surveillance is the monitoring of employee communications to identify market manipulation and other illegal or suspicious activity. Communications surveillance vendors are currently used by 15% of respondents, and 30% are considering using a vendor over the next year.

In this category, no clear leader was identified by the survey results, as no vendor was mentioned more than once, either as a vendor that is currently being used, or as a vendor that is being considered.

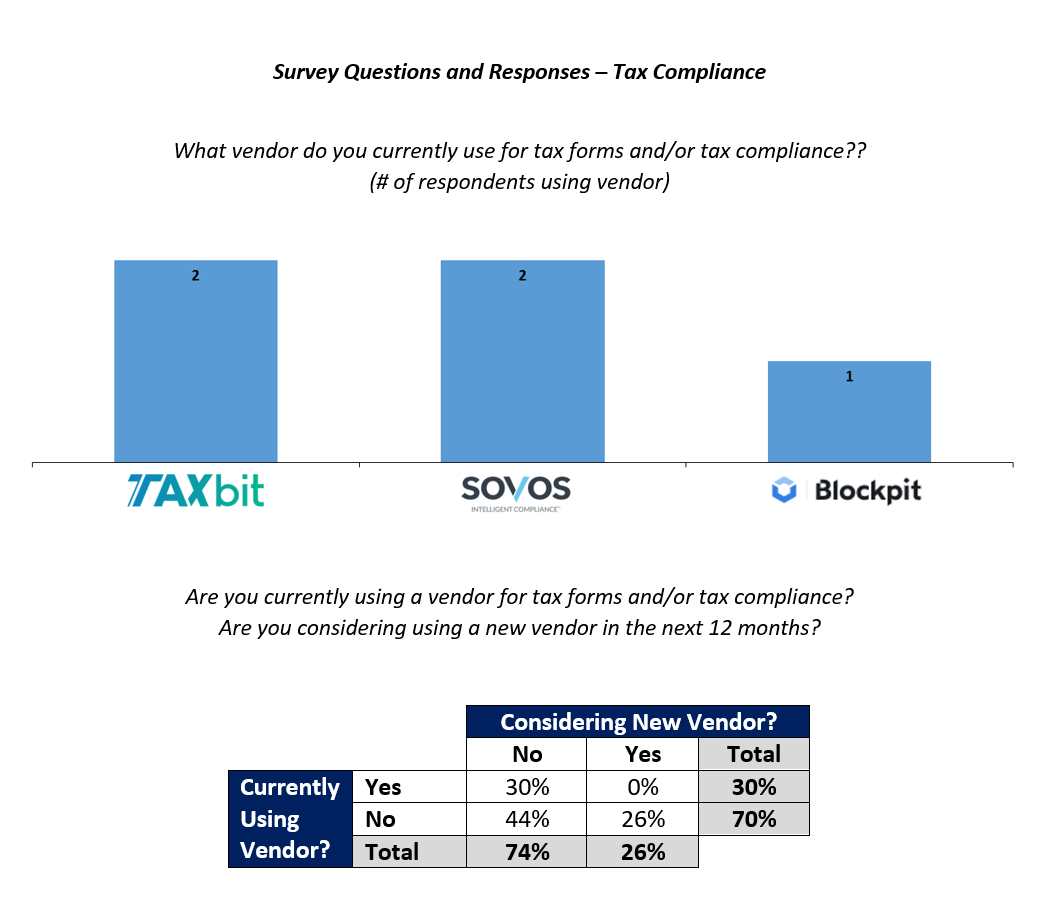

Tax compliance vendors provide services such as issuing tax forms to customers and providing tax reporting to authorities. Currently 30% of respondents are using a tax compliance vendor, and another 26% are considering using a vendor this year. Separately, we also asked if respondents currently issue tax forms to their customers, and 44% indicated that they are. The three vendors that are currently being used by respondents for tax compliance are Taxbit, Sovos, and Blockpit. The respondents who indicated they were considering using a vendor over the next year all declined to name the vendors they are considering (so no chart is shown for this question).

Conclusion

At Jump Capital, we believe the crypto industry will continue to grow exponentially over the coming years, providing financial services to billions of people and reshaping the infrastructure underpinning of many everyday financial services. We also believe that there will be increasing scrutiny of the industry as it grows, and there will be ever growing needs for compliance solutions as regulators, legislators and tax authorities turn their attention to crypto. Our hope is that best-in-class compliance solutions can enable the industry to reach its fullest potential, while also satisfying relevant authorities. We are proud to currently be investors in Eventus and TRM Labs and are looking forward to making additional investments in the crypto compliance space.