Blog

Jump Capital Crypto Compliance Survey

7/26/2021

Birthed as “A Peer-to-Peer Electronic Cash System” Bitcoin has been touted as the ultimate disruptor to the financial system, both as a medium of exchange and as a store of value. At Jump Capital, we believe that Bitcoin will fulfil its destiny as the greatest store of value the world has ever known and are intrigued by the Lightning Network which increases its usability as a medium of exchange. However, our belief is that stablecoins will be the dominant medium of exchange crypto-asset in the near to mid-term. We believe that accelerating adoption of stablecoins in the coming years will transform payments and lead to the value of stablecoins outstanding to continue to grow exponentially into the trillions of dollars.

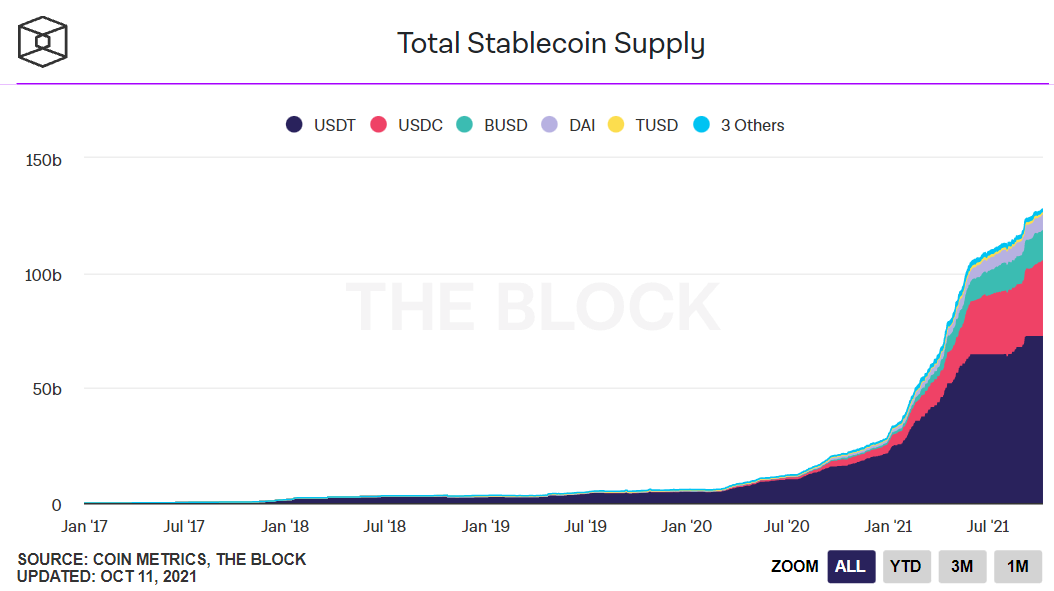

Stablecoins are cryptographic tokens which track the value of sovereign currencies (typically the US dollar), and over the last year [DG1] , the adoption of stablecoins has seen a meteoric rise, with the value of stablecoins outstanding growing from ~$20bn to ~$130bn. This is partially due to the increase in crypto trading volumes, but also indicative of several new use cases beginning to gain traction.

Stablecoins are predominantly used today as the base pair for most crypto exchange markets. The rise in crypto adoption and the liquidity in stablecoin pairs has led to the proliferation of exchanges which enable people in most international markets to easily gain access to stablecoins. We believe that this increase in access to, and interaction with, stablecoins around the world opens the floodgates for a variety of use cases which will propel stablecoins to multiple trillions of dollars of outstanding value. This belief is based partially on benchmarking to the Eurodollar market, which represents the value of USD deposits held outside the US banking system and is currently estimated to be around $20 trillion. The growth of stablecoins will serve as a replacement of the traditional Eurodollar market in some instances but will also dramatically increase the availability of assets tracking the value of the US dollar outside the US banking system, and thus the size of this overall market.

To-date, the rise of stablecoins has primarily been driven by their usage as a dollar denominated trading and settlement account for crypto traders. Stablecoins have enabled traders and exchanges around the world to use the US dollar as a base trading pair, without requiring these traders and exchanges to have US bank accounts. They have also given traders 24/7 access to quickly transfer funds between trading venues. Due to this, stablecoin-based trading pairs are the highest volume and most liquid crypto markets in the world – with ~75% of crypto spot volume using a stablecoin as the base currency.

This earliest use of stablecoins has led to the proliferation of user-friendly on-ramps around the world from local currencies to USD stablecoins. Traders using stablecoins is now a relatively mature use case that has paved the way for more mainstream use cases.

A) Remittances & B2B Payments

Remittances and B2B payments have been one of the earliest use cases of stablecoins. With businesses and workers becoming increasingly global, individual remittance flows continue to grow, and many small and mid-sized companies now have international suppliers and vendors. Due to capital controls, regulatory hurdles, and monopolized payment corridors, these cross-border and cross-currency transactions can be difficult to complete, take several days, and may incur high fees or wide spreads on currency conversions. Now, using stablecoins and local fiat on/off ramps, individuals and businesses can send international transfers within seconds. Stablecoins are increasingly being used as the cross-border leg of these transactions, where one fiat currency is converted to stablecoins, sent to the other country, and then converted to the second fiat currency. New cross-border / remittance focused players are also emerging which abstract the use of crypto on the backend to serve mainstream audiences. Of the non-trading use cases discussed in this report, we believe this is the most mature.

Example companies:

B) Cross-border Payroll

As workforces become more distributed, businesses are increasingly looking to hire the best talent in a geography-agnostic manner. For small and medium size business that do not have international locations, using stablecoin rails to pay geographically distributed talent makes a challenging process more convenient. The white space here is a front-end platform that makes the process easier for businesses, while helping them comply with local laws and tax withholding requirements. This segment is still relatively under-penetrated, though a few players have begun building.

Example companies:

C) Borderless Capital Markets

In addition to facilitating cross-border payments, stablecoins also allow borderless participation in capital markets. Stablecoins now underpin several decentralized credit markets including overcollateralized loans via Compound and Maker, and uncollateralized loans via TrueFi and Maple Finance. Global audiences can also borrow from and lend to (via interest bearing deposits) centralized counterparties such as BlockFi. Through both decentralized and centralized platforms, stablecoins make it possible for anyone around the world to access the best capital markets instantaneously.

Example companies:

D) Digital Economies

As stablecoins become more widely used, we expect them to fuel the growth of purely digital online economies. From payments for NFTs, to tips on Twitter and online content subscription business, there will be an explosion of monetization of online services and goods as stablecoins enable everyone in the world to transact with everyone else. This will pave the way for stablecoins to be the de facto currency of the Metaverse, in whatever form that might take.

Eventually, as stablecoins become more prominent around the world, and the aforementioned use cases increase stablecoins held by individuals, businesses and individuals will begin accepting stablecoins for local transactions. This would be particularly valuable for countries with weak local currencies where we expect to see a groundswell of cryptodollarization as stablecoins become a predominant method of commerce. We also expect to see increasing usage in developed markets as users realize the benefits of 24/7 instant payments (vs. other payment methods such as bank wires), and fintech and payments companies integrate stablecoins as an underlying money movement rail.

Which Stablecoin(s) Will Be the Winner(s)?

Stablecoins come in a variety of structures, with the primary ones being:

We believe there will be several winners in the stablecoin space, as there is a spectrum of users who put more or less value on the elements of decentralization, stability, capital efficiency, and integration with regulatory regimes. We are particularly excited about Terra and their dollar stablecoin UST, which we believe is the most elegant solution for creating a highly scalable and more decentralized stablecoin.

Conclusion

Stablecoins enable an open network monetary system where, for the first time ever, anyone in the world can hold and transact in dollars (or any other fiat currency put on a blockchain) and have 24/7 near-instant final settlement of these transactions. With the proliferation of domestic fiat on and off ramps, we believe that over the next decade, stablecoins use cases will move far beyond just trading. In addition to being fast, cheap, and easily available, stablecoins also do not require a crypto-native front end to operate. This will allow builders to create applications on these rails that are easy to use and enable mainstream adoption. As stablecoin rails are used for everything from remittance and cross-border payroll, to powering domestic economies, we believe the value of stablecoins outstanding will grow into a multi-trillion-dollar market. At Jump Capital, we are looking forward to continue backing the companies that power this exponential growth.